Why ClearShares OCIO ETF?

ClearShares OCIO ETF (NYSE ARCA:OCIO) seeks to outperform a traditional 60/40 mix of global equity and fixed-income investments.

The fund is actively managed. Its diversified holdings are primarily focused in passive, index-based ETFs, but OCIO also utilizes actively managed ETFs or individual securities when management believes it advantageous.

A cost-effective alternative to the traditional outsourced chief investment officer (OCIO) model. The fund integrates the cost advantages and transparency of an ETF structure with the experienced professional management, research, and analytics of the traditional OCIO model.

Active management where we believe it's likely to deliver the most value. The Investment Team focuses their experience, research, and analytics where they have greatest potential to add alpha and enhance long-term performance.

A potential core- or total-portfolio solution. Fees and minimums may be less than other outsourced arrangements. The ETF structure can also be much less costly and cumbersome than building a portfolio of individual securities or ETFs in-house.

Transparent & factor-neutral. OCIO ETF is factor-agnostic in selecting holdings for inclusion in the portfolio.

OCIO opportunistically utilizes a Covered Call strategy to produce a diversified income stream while offsetting potential market losses. The options overlay strategy is expected to provide positive returns in flat or rising equity markets, and could offset losses due to the premiums received from the options

Disciplined risk management. Risk analysis is embedded in our investment process, and OCIO ETF does not invest in ETFs that employ high levels of leverage, derivatives, or highly illiquid securities. OCIO ETF typically limits investments in any single ETF to a maximum of 5% of total assets. We do not use leverage at the fund level.

The OCIO Advantage

An innovative investment solution integrating the expertise of the OCIO model with the cost advantages of an ETF

Investment Process

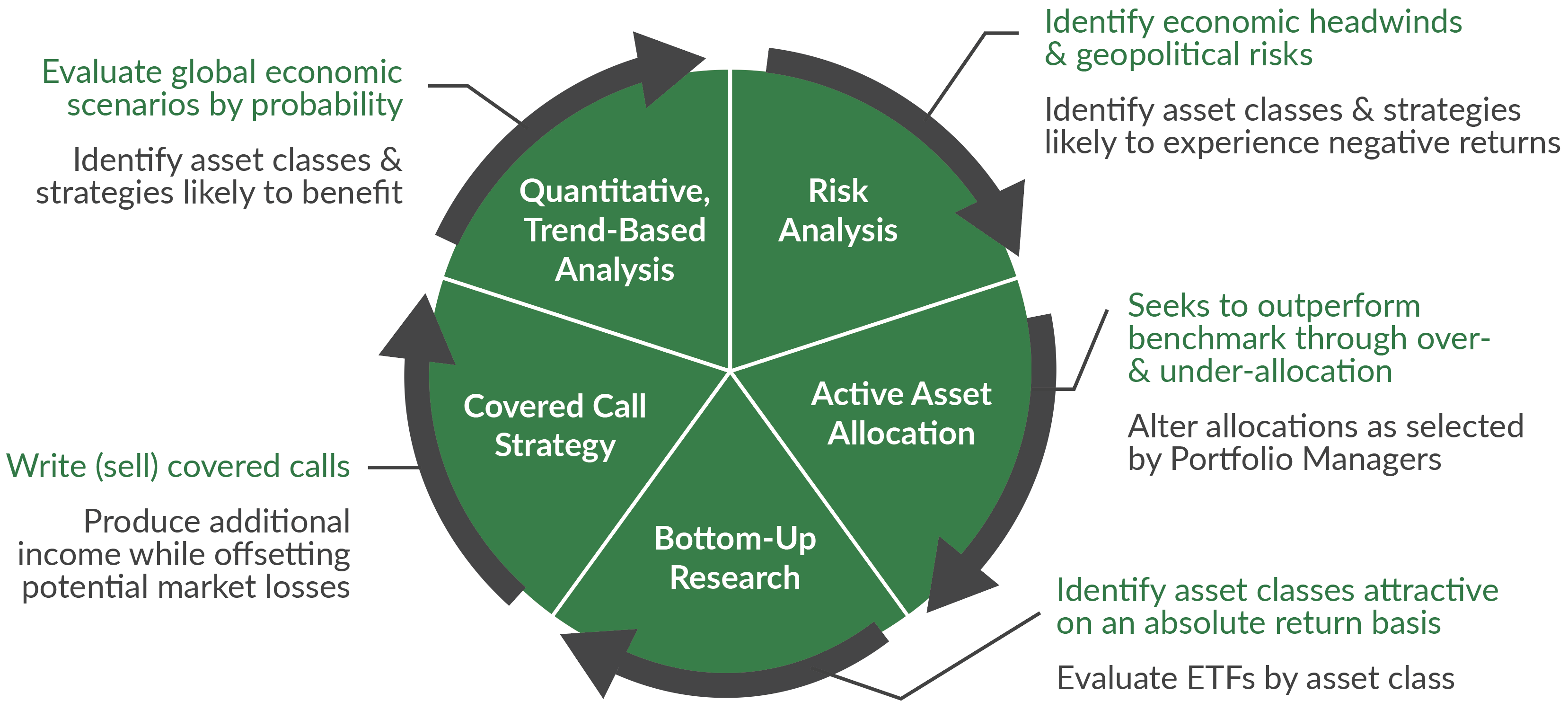

A collaborative, disciplined investment process:

1. Quantitative, trend-based analysis: We use macroeconomic research and analysis to isolate forward-skewed opportunities. Our analysis also evaluates global economic scenarios by probability of occurrence and seeks to identify the markets, asset classes, sectors, styles, and geographic regions best positioned to deliver positive absolute and relative returns.

2. Risk analysis: We also seek to identify markets, asset classes, sectors, styles, and geographic regions at risk – those that may encounter negative headwinds over the next 3-12 months. Among the factors included in our analysis are the price series and trend of each holding, credit spread levels, market volatility, yield curve shape, energy prices, market correlations, and currency risks.

3. Bottom-up research: We seek to identify asset classes that are attractive on both an absolute and relative basis, and to select optimal global equity, fixed income, and inflation hedged investments.

4. Active asset allocation: We seeks to generate active alpha through over- and under-allocation weights for asset classes, geographic regions, sectors, and investment styles. The Portfolio Managers set ongoing allocations based on their assessment of opportunities and risks at the global macroeconomic level.

5. Covered call strategy: We expect to write (sell) covered calls on approximately 1-10% of total assets using monthly call options. Our strategy seeks to produce additional income while offsetting potential market losses.

Past performance is not indicative of future results. References to efforts to mitigate or “control” risk reflect an effort to address risk but do not mean that the portfolio risk can be completely controlled. All investment has risk, including the risk of loss of principal.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully before you invest.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV) and may trade at a discount or premium to NAV. Shares are not individually redeemable from the Fund and may be only be acquired or redeemed from the fund in creation units. Brokerage commissions will reduce returns. Additional risks include, but are not limited to investments in debt securities including high yield and mortgage and asset backed securities, foreign and emerging markets securities, REITs, MLPs, small-and mid-cap securities, and investment in other ETFs. The fund invests in other investment companies and bears its proportionate share of fees and expenses of other investment companies. Please refer to the prospectus for additional risks of investing in the fund.

Asset Allocation Risk The fund may favor an asset category or investment strategy that performs poorly relative to other asset categories and investment strategies for short or long periods of time.

Investment Company Risk The risks of investing in investment companies, such as the Underlying Funds, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company. The Fund may be subject to statutory limits with respect to the amount it can invest in other ETFs, which may adversely affect the Fund’s ability to achieve its investment objective. Investments in ETFs are also subject to the following risks: (i) the market price of an ETF’s shares may trade above or below their net asset value (“NAV”); (ii) an active trading market for an ETF’s shares may not develop or be maintained; and (iii) trading of an ETF’s shares may be halted for a number of reasons.

Management Risk The fund is actively-managed and may not meet its investment objective based on the Adviser’s success or failure to implement investment strategies for the Fund.

Alpha Often considered the active return on an investment, gauges the performance of an investment against a market index used as a benchmark, since they are often considered to represent the market's movement as a whole. The excess returns of a fund relative to the return of a benchmark index is the fund's alpha.

ClearShares LLC is the investment advisor to ClearShares OCIO ETF which is distributed by Quasar Distributors, LLC.