Why Piton Intermediate Fixed Income ETF?

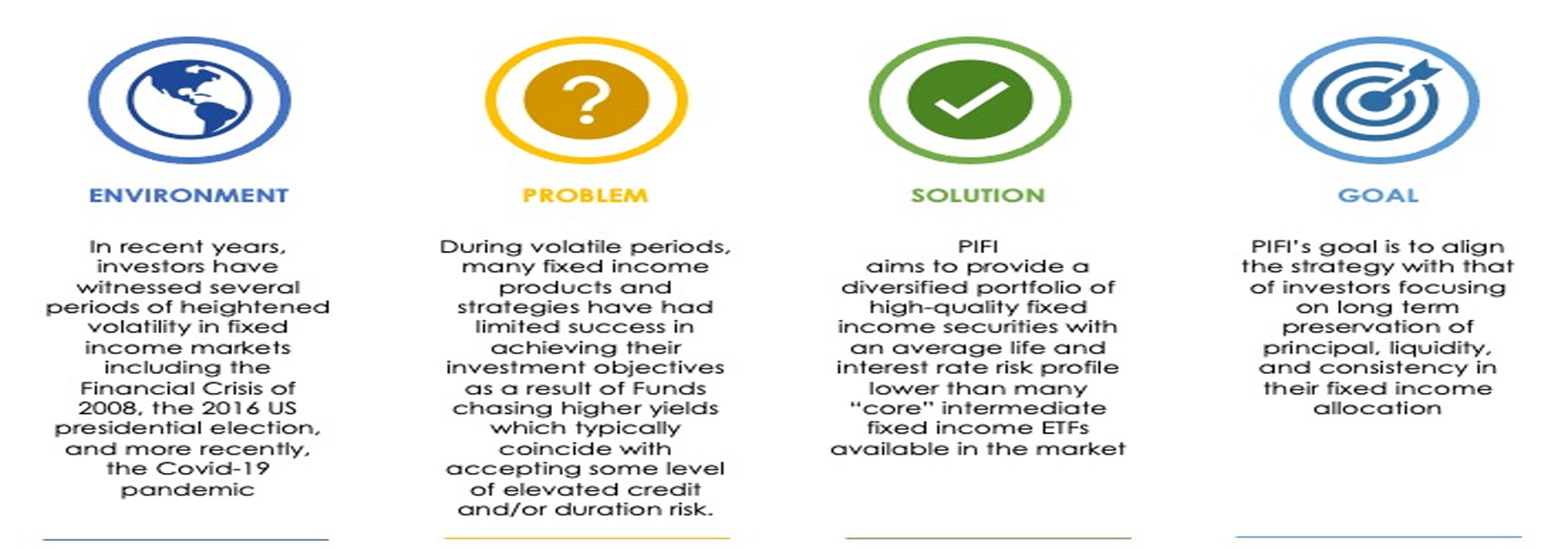

In recent years, investors have witnessed several periods of heightened volatility in fixed income markets including the Financial Crisis of 2008, the 2016 US presidential election, and more recently, the Covid-19 pandemic. During these volatile periods, many fixed income products and strategies have had limited success in achieving their investment objectives as a result of chasing higher yields which typically coincide with accepting some level of elevated credit and/or duration risk¹. The Piton Intermediate Fixed Income ETF (NYSE: PIFI), seeks to provide a diversified portfolio of high-grade fixed income securities with an average life and interest rate risk profile that is lower than many “core” intermediate fixed income ETFs available in the market. BTC’s goal is to align the strategy with that of investors focusing on long term preservation of principal, liquidity, and consistency in their fixed income allocation by investing in securities with a maturity of 0-10 years and duration risk in the range of 3-5 years.

Piton Investment Management

Piton Investment Management, LP (“Piton”) is an independent SEC-registered investment advisor based in New York City. Piton was founded in 2015 and provides specialized fixed income investment advisory services to pooled investment vehicles as well as separately managed accounts utilizing US government securities, corporate bonds, and municipal securities. Piton has an extensive history managing fixed income assets, protecting capital, and providing dedicated service to clients through multiple interest rate environments and market cycles. The investment team has previously managed large investment portfolios for Annaly Capital (NYSE:NLY) , HSBC, and Credit Suisse Asset Management.

Portfolio Management Approach

The portfolio management team utilizes a “top-down” macro-economic approach to construct a long-term outlook for interest rate and duration risk. Managers also pursue relative valuation opportunities between fixed income asset classes and individual bond issues in both primary and secondary markets. This approach allows for a balanced objective; producing a moderate level of income while seeking total return opportunity over time. Generally, the PIFI portfolio will contain a mix of US treasury securities, US government agency bonds, corporate debt, and other high-grade securities in accordance with our macro-economic outlook. Our top-down analysis is a result of ongoing team assessment of the main factors driving macro-markets, market appetite for risk/reward, and the shape and structure of the yield curve. These factors include economic data, inflation, monetary and fiscal policy, as well as technical factors such as supply/demand and other intangible elements that may influence markets.

Credit-sensitive securities in the portfolio are selected using a “bottom-up” technique focusing on internal and external filters. Diversification is vital when holding corporate bonds in the portfolio. In addition, liquidity, and the minimization of bid/ask spreads² and transaction costs are, key tenets of the strategy. The portfolio management team invokes a conservative approach to the corporate bond sector and is very attuned to “early warnings signs” in credit deterioration.

PIFI ETF could be an attractive intermediate fixed income investment option given the following considerations:

- PIFI could replace fixed income asset allocation strategies that have taken outsized risks given investor’s need for fixed income exposure.

- The Fund will typically utilize bonds with a tenor of 0-10 years, with duration risk in the range of 3-5 years.

- PIFI utilizes large benchmark securities to ensure liquidity and low bid/ask spreads in credit sector holdings.

- PIFI seeks to pay a quarterly income distribution.

- The Fund is daily priced, daily liquid, and trades on the New York Stock Exchange

Market Opportunity

¹ Duration is a weighted average of the maturity of all the income streams from a bond or portfolio of bonds. (Source: investorguide.com)

² Bid-Ask Spread is a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. (Source: investopedia.com)

Important Disclosures

Past performance is not indicative of future results. References to efforts to mitigate or “control” risk reflect an effort to address risk, but do not mean that the portfolio risk can be completely controlled. All investment has risk, including the risk of loss of principal.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV) and may trade at a discount or premium to NAV. Shares are not individually redeemable from the Fund and may be only be acquired or redeemed from the fund in creation units. Brokerage commissions will reduce returns. The Fund invests in fixed income securities, that involves certain risks including call risk, credit risk, event risk, extension risk, interest rate risk & prepayment risk.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully before you invest.

ClearShares LLC is the investment advisor to ClearShares PIFI ETF. The ClearShares ETFs are distributed by Quasar Distributors, LLC.

Investment Company Risk. The risks of investing in investment companies, such as the Underlying Funds, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company. The Fund may be subject to statutory limits with respect to the amount it can invest in other ETFs, which may adversely affect the Fund’s ability to achieve its investment objective. Investments in ETFs are also subject to the following risks: (i) the market price of an ETF’s shares may trade above or below their net asset value (“NAV”); (ii) an active trading market for an ETF’s shares may not develop or be maintained; and (iii) trading of an ETF’s shares may be halted for a number of reasons.

Management Risk. The Fund is actively-managed and may not meet its investment objective based on the Adviser’s success or failure to implement investment strategies for the Fund.

Mortgage- and Asset-Backed Securities Risk. The Fund may invest in U.S. government agency-backed mortgage- and asset-backed securities. Mortgage- and asset-backed securities are subject to interest rate risk.

New Fund Risk. The Fund is a recently organized, diversified management investment company with no operating history. As a result, prospective investors have no track record or history on which to base their investment decision. Additionally, the Adviser has not previously managed a registered investment company, which may increase the risks associated with investments in the Fund.

Non-Diversification Risk. The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a smaller number of issuers than a fund that invests more widely.

Diversification does not assure a profit nor protect against loss in a declining market.

Credit Quality weights by rating are derived from the highest bond rating as determined by Standard & Poor’s (“S&P”), Moody’s, Fitch, DBRS, Morningstar, and Kroll. Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as S&P, Moody’s, Fitch, DBRS, Morningstar, and Kroll. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when none of the three rating agencies have issued a formal rating, the Advisor will classify the security as nonrated.