Why ClearShares OPER ETF?

After a prolonged holding pattern and great speculation in the market on how the Fed would address conflicting economic indicators and persistent inflation, the FOMC finally started their march towards a lower rate environment. With the uncertainty of the election behind us, we can look for signs of how the new administration will address open questions regarding the role of the Fed in monetary policy, national debt, and the stability of the currency. It will be more important than ever to understand and manage volatility in the near future as investors attempt to interpret the breadth and depth of potential policy changes that are likely to be implemented very quickly as the new administration settles in. Many of the proposed near-term, and even medium-term policy changes, have the potential to greatly impact the fixed income and equity markets. Employment numbers continue to be revised downward and, despite the reduction in the Fed Funds Target Range, bond yields remain elevated.

During the last year, the Fed has reduced it’s balance sheet by almost $600 billion¹ and has conveyed it expects to continue to reduce securities positions over time. As the balance sheet reduction proceeds, the securities must be digested by the markets and those investors will therefore require financing, typically driven by the security types involved, the quantity liquidated, and the timing of the operations in question. This action has the potential to exert pressure on the availability and cost of the required funding and may have an unexpected impact on the fixed income markets. While there remains much uncertainty around the direction and timing of short-term rate moves and funding availability, OPER will be vigilant during periods of fixed income volatility and opportunistic during any disruptions to the funding markets.

OPER should continue to execute on it’s strategy regardless of the rate environment, and may be an attractive option for investors seeking current income and portfolio stability in fixed income holdings:

- OPER could replace cash holdings and short-term bond funds in fixed income portfolio holdings

- While OPER is permitted to hold securities, it typically does not when employing it’s core investment strategy which may reduce sensitivity to market volatility and yield curve risks

- OPER primarily accepts collateral issued by the US Treasury and government agencies

- OPER receives a minimum of 2% excess collateral pledged against each lending agreement

- OPER has historically paid a monthly distribution based on interest earned from these “repos”

- The Fund is daily priced, daily liquid, and trades on the New York Stock Exchange Arca

What is a Repo

Repurchase agreements (“repos”) are short-term funding transactions widely used by banks, securities firms, and hedge funds to finance their securities inventory. They utilize this vehicle for its liquidity and safety. A repo is the sale of a security with a simultaneous commitment by the seller to repurchase the security from the buyer at a future date at a higher, predetermined price. This price differential represents the interest earned on the lending transaction. This transaction allows one party (the seller) to obtain financing from the other party (buyer).

A repo is secured by collateral, protecting the buyer against the potential risk of the seller being unable to repurchase the securities as agreed. The transaction from the lender’s perspective is called a reverse repurchase agreement (“reverse repo”) and may also be thought of as a collateralized loan. Repurchase agreements are typically short-term agreements and their maturity period is called the “term” or the tenor.

What is it?

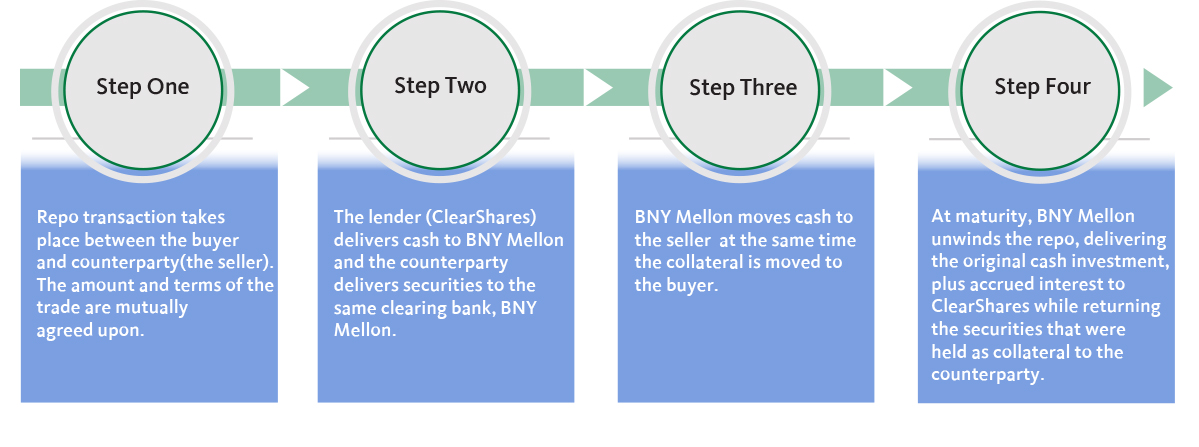

Tri-party repos are the most common type of repo and are popular because of their operational efficiency and safety. In this type of arrangement, the buyer and seller agree to the terms of the transaction and report the details to a third-party custodian (BNY Mellon). BNY Mellon, one of the largest financial institutions in the world, serves as the fiduciary/custodian for participants in the tri-party repo market. Specifically, BNY Mellon handles all settlement and operational issues associated with the tri-party repo transactions, and ensures the buyer’s account has the agreed class of securities and is over-collateralized per the trade terms.

When the buyer (lender of cash) and the counterparty (borrower of cash) execute a transaction, the collateral and cash flow through one custodial bank. OPER ETF utilizes BNY Mellon for it’s tri-party transactions to provide clearing and trade settlement services, collateral pricing, and to help facilitate collateral substitution.

Sources:

- Federal Reserve Bank of St. Louis

* One basis point is the equivalent of 1/100 of a percent or 0.01%

The Tri-Party Repo Process

Past performance is not indicative of future results. References to efforts to mitigate or “control” risk reflect an effort to address risk, but do not mean that the portfolio risk can be completely controlled. All investment has risk, including the risk of loss of principal.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV) and may trade at a discount or premium to NAV. Shares are not individually redeemable from the Fund and may be only be acquired or redeemed from the fund in creation units. Brokerage commissions will reduce returns. The Fund invests in fixed income securities, that involves certain risks including call risk, credit risk, event risk, extension risk, interest rate risk & prepayment risk. Repurchase agreements may be construed to be collateralized loans by the Fund, and if so, the underlying securities relating to the repurchase agreement will only constitute collateral for the seller’s obligation to pay the repurchase price. If the seller defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. A seller failing to repurchase the security coupled with a decline in the market value of the security may result in the Fund losing money. The Fund may invest in repurchase agreements that are deemed illiquid due to having a term of more than seven days. Please refer to the prospectus for additional risks of investing in the fund.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully before you invest.

ClearShares LLC is the investment advisor to ClearShares OPER ETF. The ClearShares ETFs are distributed by Quasar Distributors, LLC.

Investment Company Risk. The risks of investing in investment companies, such as the Underlying Funds, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company. The Fund may be subject to statutory limits with respect to the amount it can invest in other ETFs, which may adversely affect the Fund’s ability to achieve its investment objective. Investments in ETFs are also subject to the following risks: (i) the market price of an ETF’s shares may trade above or below their net asset value (“NAV”); (ii) an active trading market for an ETF’s shares may not develop or be maintained; and (iii) trading of an ETF’s shares may be halted for a number of reasons.

Management Risk. The Fund is actively-managed and may not meet its investment objective based on the Adviser’s success or failure to implement investment strategies for the Fund.